07 Août Climate Change Exposure and the Value Relevance of Earnings and Book Values of Equity

If a P/B ratio is less than one, the shares are selling for less than the value of the company’s assets. This means that, in the worst-case scenario of bankruptcy, the company’s assets will be sold off and the investor will still make a profit. Book value is the amount found by totaling a company’s tangible assets (such as stocks, bonds, inventory, manufacturing equipment, real estate, and so forth) and subtracting its liabilities. In theory, book value should include everything down to the pencils and staples used by employees, but for simplicity’s sake, companies generally only include large assets that are easily quantified. Earnings, debt, and assets are the building blocks of any public company’s financial statements.

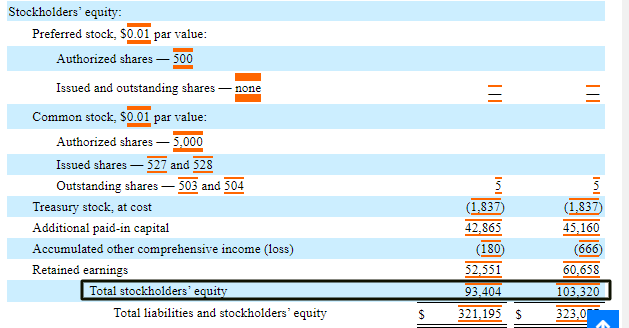

Book Value on a Balance Sheet

In this case, the value of the assets should be reduced by the size of any secured loans tied to them. Manufacturing companies offer a good example of how depreciation can affect book value. These companies have to pay huge amounts of money for their equipment, but the resale value for equipment usually goes down faster than roadmap and milestones a company is required to depreciate it under accounting rules. As the equipment becomes outdated, it moves closer to being worthless. If it’s obvious that a company is trading for less than its book value, you have to ask yourself why other investors haven’t noticed and pushed the price back to book value or even higher.

Assets and Liabilities

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Navigate Through Book Value Calculations to Evaluate Your Business’s Worth

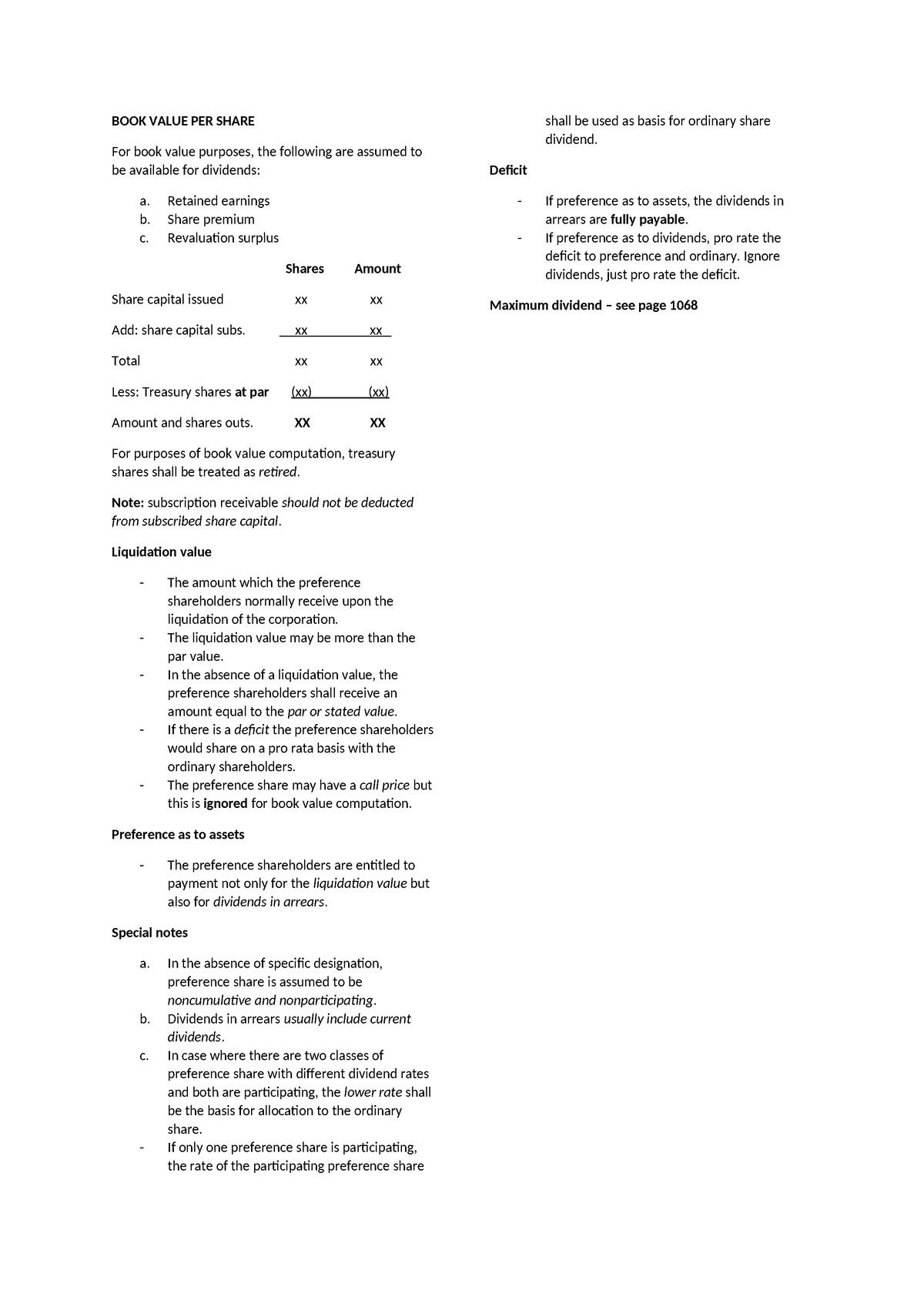

The book value of an asset is the amount of cost in its asset account less the accumulated depreciation applicable to the asset. The book value of a company is the amount of owner’s or stockholders’ equity. The book value of bonds payable is the combination of the accounts Bonds Payable and Discount on Bonds Payable or the combination of Bonds Payable and Premium on Bonds Payable.

While small assets are simply held on the books at cost, larger assets like buildings and equipment must be depreciated over time. The asset is still held on the books at cost, but another account is created to account for the accumulated depreciation on the asset. Learning how to calculate book value is as simple as subtracting the accumulated depreciation from the asset’s cost. Book value in this definition is determined as the net asset value of a company calculated as total assets minus intangible assets and liabilities.

Book Value of an Asset Formula

Modern finance theories have revolutionized the way accounting values are perceived. Depreciation, on the other hand, is the allocation of the cost of an asset over its useful life. It is a non-cash expense that reduces the value of an asset on the balance sheet over time. Accounting is a system that helps organizations to record, analyze, and report financial information.

The fair value method is used to determine the value of assets based on their current market price. This method is used when the market price of an asset is readily available. To measure the value of an entity’s resources, accounting values use metrics such as cost, market value, and fair value. Accounting values are based on fundamental concepts that guide the preparation of financial statements, such as the accrual basis of accounting, the going concern assumption, and the matching principle. When you first purchase an asset, you record its value in your accounting books. And, you should create an annual journal entry for its depreciation expense.

That said, looking deeper into book value will give you a better understanding of the company. In some cases, a company will use excess earnings to update equipment rather than pay out dividends or expand operations. While this dip in earnings may drop the value of the company in the short term, it creates long-term book value because the company’s equipment is worth more and the costs have already been discounted. An investor looking to make a book value play has to be aware of any claims on the assets, especially if the company is a bankruptcy candidate. Usually, links between assets and debts are clear, but this information can sometimes be played down or hidden in the footnotes.

- An investor looking to make a book value play has to be aware of any claims on the assets, especially if the company is a bankruptcy candidate.

- Market value is the price at which an asset or liability could be sold in an open market.

- Finding those bargains can be challenging because stocks that are obviously underpriced tend to self-correct quickly.

- Oddly enough, this has been a constant refrain heard since the 1950s, yet value investors continue to find book value plays.

- The formula doesn’t help individuals who aren’t involved in running a business.

To put this into an example, let’s say that your company has total assets that are valued at £100,000 and total liabilities of £80,000. They could make a large amount of money but still be working at a loss. That’s why potential investors or shareholders need to dig a bit deeper into the financial depths of a business. When the market value is near or less than the book value, the P/B ratio will be 1 or less, signaling that the stock may be undervalued. An undervalued stock can be a great bargain, particularly if company fundamentals are strong and the investor has a long timeline.

However, the book value of an investment is marked to market periodically in an organization’s balance sheet, so that book value will match its market value on the balance sheet date. Value investors look for relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals in their quest to find undervalued companies. A P/B ratio of 1.0 indicates that the market price of a share of stock is exactly equal to its book value. For value investors, this may signal a good buy since the market price generally carries some premium over book value.

It may not include intangible assets such as patents, intellectual property, brand value, and goodwill. It also may not fully account for workers’ skills, human capital, and future profits and growth. Therefore, the market value, which is determined by the market (sellers and buyers) and represents how much investors are willing to pay after accounting for all of these factors, will generally be higher. For a company, a simple book value is calculated by subtracting total liabilities from total assets. More detailed book values take other factors into account, such as also deducting intangible assets. In accounting, book value is the value of an asset[1] according to its balance sheet account balance.